Post

The Business of Politics: Where Do We Go From Here?

Mixing business and politics is nothing new. In the first annual message to the US Congress in 1801, Thomas Jefferson penned, “Agriculture, manufactures, commerce, and navigation, the four pillars of our prosperity, are the most thriving when left most free to individual enterprise.” The Founding Fathers deeply understood the struggle against government oppression. Not only does an overcentralized government oppress individual rights, but it also restricts…

Post

The Negative Impact of Impact Investing

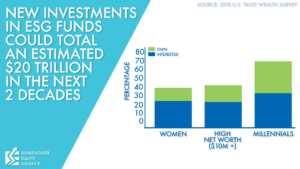

U.S. corporate culture has come to an unfortunate place. Activists demand that companies’ first priority should not be to serve a unique purpose and make a profit, but to be stewards of the social and environmental justice whims of the day. One of the newest ways political activists are promoting this philosophy is through “impact investing.” That means return on investment (ROI) is secondary to being socially and…

Post

Corporate Social Responsibility: Flawed Inputs Mean Flawed Outputs

Corporate social responsibility is the hot new topic around investing – so it’s worth considering how we decide which companies qualify as responsible. In a recent blog post, we explained why it’s impossible to come to a common understanding of measuring ESG (environmental, social, and governance) metrics, which would be expected to coincide with which funds are socially responsible. But “societal problems” are in the eye of the beholder.

Post

Unsurprisingly, CEOs’ “Stakeholder Capitalism” Fails to Satisfy Proponents

In August 2019, the Business Roundtable (BRT), led by 181 CEOs of some of the world’s largest companies, introduced its “Statement on the Purpose of a Corporation.” According to the statement, Milton Friedman’s foundational conclusion – that corporations should prioritize maximizing shareholder value – was a thing of the past. Today’s corporations should take a more principled stance, seeking to “maximize value” for all stakeholders. While this fundamental shift…

Post

The Pipe Dream of Standardizing ESG Metrics

On CNBC’s Squawk Box last week, Bank of America CEO Brian Moynihan introduced his call to streamline ESG (Environmental, Social, and Governance) metrics across companies. Armed with “three Cs” – comprehensiveness, convergence, and clarity – Mr. Moynihan advocated for wide adoption of standardized metrics. He argued this would allow stakeholders, broadly defined, to “bring capitalism to task.” In other words, according to Mr. Moynihan, companies can solve social problems.

Post

Voice Your Vote

As a retail investor, you own a part of every company whose shares you own. Whether you own them directly, contribute to an IRA, or have a 401(k), you have the right to make your opinion heard about the companies you own a part of, and the direction they’re headed in. Retail shareholders own 30% of the total shares of a publicly traded company. But…

Post

The Power of Your Voice Doesn’t End at the Annual Meeting

Philanthropy in business should be celebrated. But regardless of what cause the company is promoting, the success of the company must remain the priority. If you own shares – even if you own a 401k – you should pay attention to the reputational risks involved with companies’ charitable dollars. Where they give, and where they refuse to give, could impact your financial future. Just ask Amazon.

Post

Viewpoint Diversity: Why It’s Good for Business and What Can Be Done About It

There are venues for activists and individuals pursuing political or legal outcomes: the ballot box, the courts, the town square. But over the years, it has grown increasingly popular for activists to use the corporations’ annual meetings to push their political agendas. Whether their agendas are fringe or mainstream is irrelevant. If activists push for it, voting against it puts the company’s “morality” on the line.

Post

Let Business Do What They Do Best: Business

Shareholder meetings, which the SEC requires annually, used to be a time to conduct real business. Shareholders and the board took on relatively mundane tasks. They ratified directors and audits, reviewed share ownership, discussed executive compensation, and the like. But while no one was looking, impact investors and political activists realized they could use this corner of the business world to their advantage. Slowly but surely,…

Post

Harness Your Shareholder Power

Too often as a shareholder, we are passive with our decisions in the stock market. We trust an advisor to purchase shares in companies that will yield a high return. We might go as far as checking our account every couple of months, but we are just patiently awaiting the day to reap what we’ve sown. Out of sight, out of mind. But what most shareholders don’t realize is that…