Uncategorized

Post

How BlackRock in the Presidential Administration Will Hurt Your Wallet

When it comes to setting the course on Wall Street’s priorities, not many firms can compete with BlackRock. The firm is the world’s largest asset manager, with $7.81 trillion in assets under management. It’s to be expected that they would be enormously influential in the corporate sphere. It’s somewhat more surprising to see BlackRock take on the role of issue advocate with increasing audaciousness. But that issue advocacy is…

Post

The Mandatory Diversity Quota from NASDAQ

Diversity is a trendier concept than ever, and corporate America is setting the course. Late last year, Nasdaq submitted a proposal to the Securities and Exchange Commission (SEC) to “enhance investor confidence.” As written, it would require companies to meet a diversity quota on their boards of directors. The proposal mandates that each company have at least two “diverse” directors: one who self-identifies…

Post

With the Green Energy Push, Voting Your Shares Is More Crucial than Ever

It’s not a surprise green energy advocates have blacklisted oil companies and natural gas producers. That much is obvious from a US Senate report from the Special Committee on the Climate Crisis. As an aside, it’s somewhat more surprising to see the inclusion of nuclear energy plants on the blacklist. After all, nuclear plants produce some of the most reliable carbon-free energy. But choosing winners and losers based on…

Post

“The Great Reset”? How World Economic Forum Goals Hurt Shareholders

Every year in January, some of the world’s most powerful, wealthy, and influential people descend on the tiny resort town of Davos, Switzerland. They represent the pinnacle of business, culture, and politics, and they come for the World Economic Forum (WEF). Together, they spend four days discussing their grand plans to improve society. At least, that’s what observers might conclude, based on the 2021 theme: “The Great Reset.” Klaus Schwab,…

Post

As Individual Investors Flood the Market, Let’s Put Shareholders First

The coronavirus pandemic has changed American society in more ways than we can count. But at least one outcome was surprising, and it will also be enormously beneficial to many Americans’ financial futures. Despite a huge downtown in the global economy, the growth in individual investors ballooned. Trading in the market without the go-between of a bank, mutual fund, or financial advisors had huge opportunities this year. Individual investors made…

Post

How Proxy Advisors Hurt Your Bottom Line

Along with the growing trend of shareholder activism, the influence of proxy advisors on institutional shareholder votes has increased tremendously — and that’s not necessarily a good thing. Proxy advisory firms make recommendations to institutional shareholders on how they should vote on shareholder proposals. But these firms’ motivations go beyond financial considerations, and their impact can be detrimental to retail investors’ bottom line. There are two…

Post

Sustainable Finance or Big Bank Censorship?

For the last decade, environmental and shareholder activists have been increasing pressure on companies to move towards sustainable finance and to divest from fossil fuels. Recently, those actions have spurred some major changes from big banks. Morgan Stanley said they will take responsibility for greenhouse gas emissions from projects that they finance. Similarly, JP Morgan and Goldman Sachs announced they will stop…

Post

The SEC Updated Rule to Level the Playing Field for Shareholders

Submitting shareholder proposals has traditionally required a fairly low barrier to entry. Currently, if you own $2,000 in stock in a company for one year, you can submit shareholder proposals. At the annual meeting, shareholders review proposals and vote whether to make them part of the company’s guiding principles. Unfortunately, political activists without the company’s best interests at heart have exploited that low barrier to entry. In response,…

Post

Zappos Adaptive: Doing Good For Others, Doing Good For Business

In 2014, Tonya Richardson called customer service at Zappos, a shoe company known for comfortable, utilitarian footwear. She told the customer service representative she had received the wrong pair of shoes. The representative told Tonya the shoes she ordered were out of stock with no similar options to choose from. This was a problem for Tonya, because the shoes she had ordered were not ordinary shoes.

Post

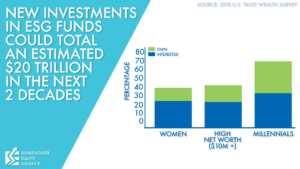

ESG Investing: Which Came First, the Chicken or the Egg?

In modern investing, especially investing targeted towards millennials, Environmental, Social, and Governance (ESG) investing is all the rage. ESG investing involves buying shares from companies with high ratings from at least one of the firms that rate companies on their “social responsibility.” Wealth management firms tell asset managers the best thing they can do is “tilt” portfolios to companies that prioritize high ESG ratings. They cite a “growing” body of…