Post

Retail Shareholders: Take the Reins in 2021

In the 2020 shareholder season, we saw some interesting patterns regarding shareholder proposals. Diversity and equity proposals flooded Big Tech companies. Activists pressured banks to divest from fossil fuels — despite several degrees of separation between Wells Fargo and climate change. Amazon alone saw a plethora of proposals ranging from viewpoint discrimination, to gender equality, to environmental responsibility. According to a report…

Post

Pressure Neutral Businesses to Stay Neutral

Companies and their directors have one directive: fulfill their business’ mission to the very best of their ability. Banks should strive to provide the most efficient banking services for their customers. Energy companies should produce the most reliable, most effective energy for consumers. Retailers should sell products that meet their customers’ needs and satisfaction. No matter their line of work, businesses should provide jobs and…

Post

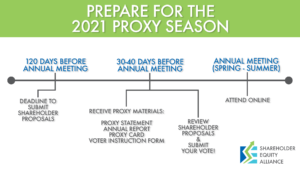

Understanding Shareholder Materials for 2021 Proxy Season

If you own shares in any public company, you will soon start receiving materials for the 2021 proxy season. In preparation for upcoming annual meetings, companies will send out a dizzying array of documents. Those might include annual or semiannual reports, as well as proxy statements. As we saw in 2020, companies are becoming increasingly politicized. It’s now in vogue for CEOs and Boards of Directors…

Post

The Wolf of Wall Street and the “Pigeon of San Francisco”

The biggest story on Wall Street for the last few weeks has been the dominance of the “little guy.” Stocks worth $6 per share a few months ago – most famously, GameStop – suddenly skyrocketed to over $360 per share. Incredibly, this had little, if anything, to do with a real shift in GameStop’s business or operations. GameStops are typically located in shopping malls; while malls were declining before COVID-19,…

Post

Politics Invades the Boardroom

There are several traditional barometers for measuring a company’s success. They include their profitability, the value customers derive from their products, and their delivery on promises to shareholders. But every year, those traditional measurements fall further and further down companies’ priority lists. That’s not a coincidence. For the past decade, political activist shareholders have sought to force companies to take up objectives more reminiscent of politics than financial success.

Post

For ESG, the Fewer Employees, the Better?

No one knows a company like its CEO. That should go without saying, but in the increasingly politicized world of shareholder advocacy, it’s a truth lost to a corporate culture of “wokeism.” CEOs, boards of directors, and other leaders of a company are being sidelined in favor of political actors offering shareholder resolutions. These activists use resolutions to pressure companies to take up their political preferences. Their preferences — things…

Post

When Companies No Longer Prioritize Shareholder Value

In 2019, almost 200 CEOs of major corporations issued a statement that their main focus is no longer on shareholder value. CEOs of BlackRock, J.P. Morgan, Amazon, and Bank of America were among those who envisioned a new corporate purpose. But their actions have consequences. As companies bow to political pressure, shareholders’ concerns have gone on the backburner. As we’ve discussed, that’s…

Post

Justin Danhof Responds to “Unconstitutional” Diversity Quota from Nasdaq

Nasdaq’s diversity quota made headlines for its prescriptive, centralized, and narrow definition of diversity. Justin Danhof, Director of the Free Enterprise Project at the National Center for Public Policy Research, called out the mandate. Not only is it illegal, it will adversely impact companies for years as they scramble to adhere to this arbitrary standard. Danhof makes…

Post

Is the Stakeholderism Debate Over? Here’s Why It Shouldn’t Be.

Just before Christmas, strategy + business declared stakeholderism the new corporate law of the land. They published a piece boldly entitled, “The stakeholder-shareholder debate is over.” Is it? And if is, is that a good thing? Fundamentally, stakeholderism isn’t a stand-alone philosophy on how to a run a business. Stakeholderism is really about opposition to Milton Friedman’s declaration on shareholder primacy. Friedman maintained that companies promote social good best when…

Post

Fight Corporate Cancel Culture: Vote With Your Wallet

From the pandemic lockdowns to rampant cancel culture, 2020 was a tumultuous year for American businesses. Shareholder activists have taken every opportunity to infiltrate corporations with their political agendas. Rightly so, American investors are on high-alert regarding the power of their dollar and their voice. Although 2021 is upon us, it’s clear small businesses continue to need our help to recover from last year. After voicing your vote…